Schedule 1 1040 Form 2025 – Graduate Aptitude Test in Engineering (GATE) 2025 application correction window closes today, November 24. Candidates who want to make changes in their GATE 2025 application form can edit their . Schedule A (Form 1040 or 1040-SR): Itemized Deductions is it is $20,800. For the tax year 2025, the standard deduction for single taxpayers and married couples filing separately is $14,600. .

Schedule 1 1040 Form 2025

Source : tuition.asu.edu

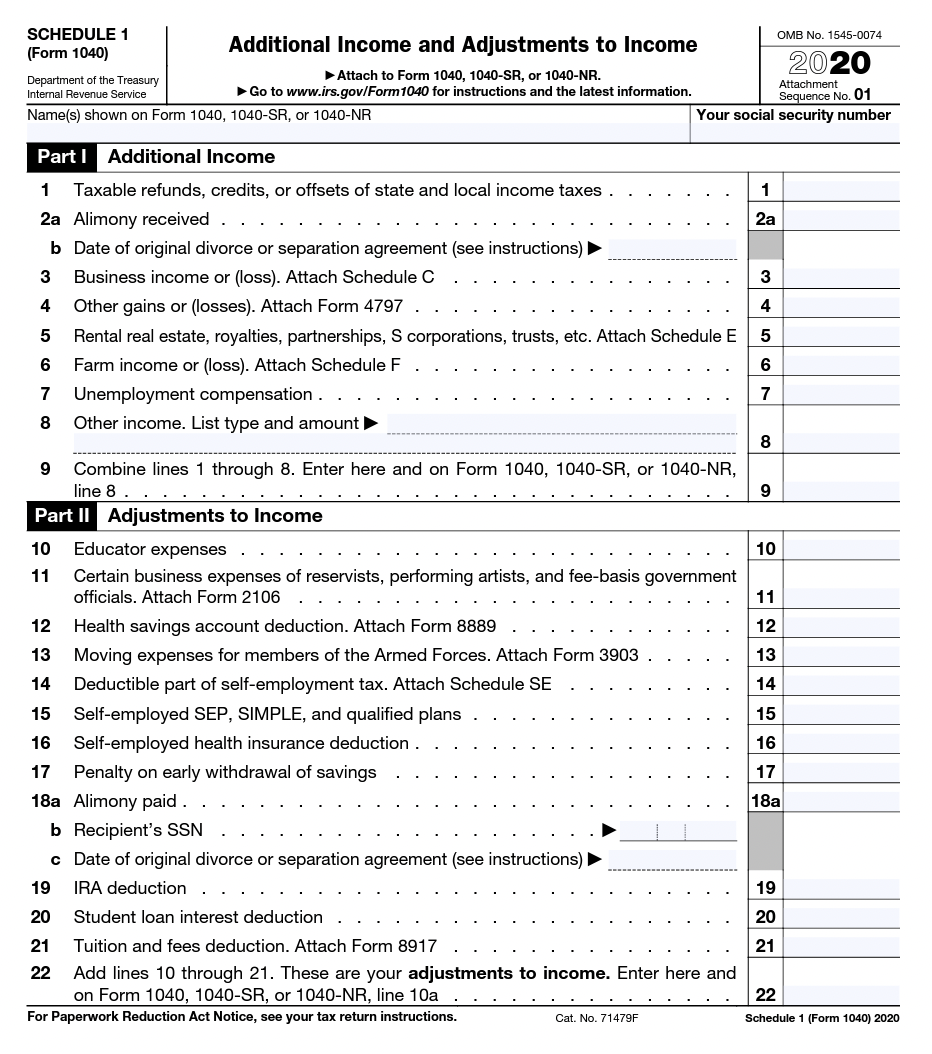

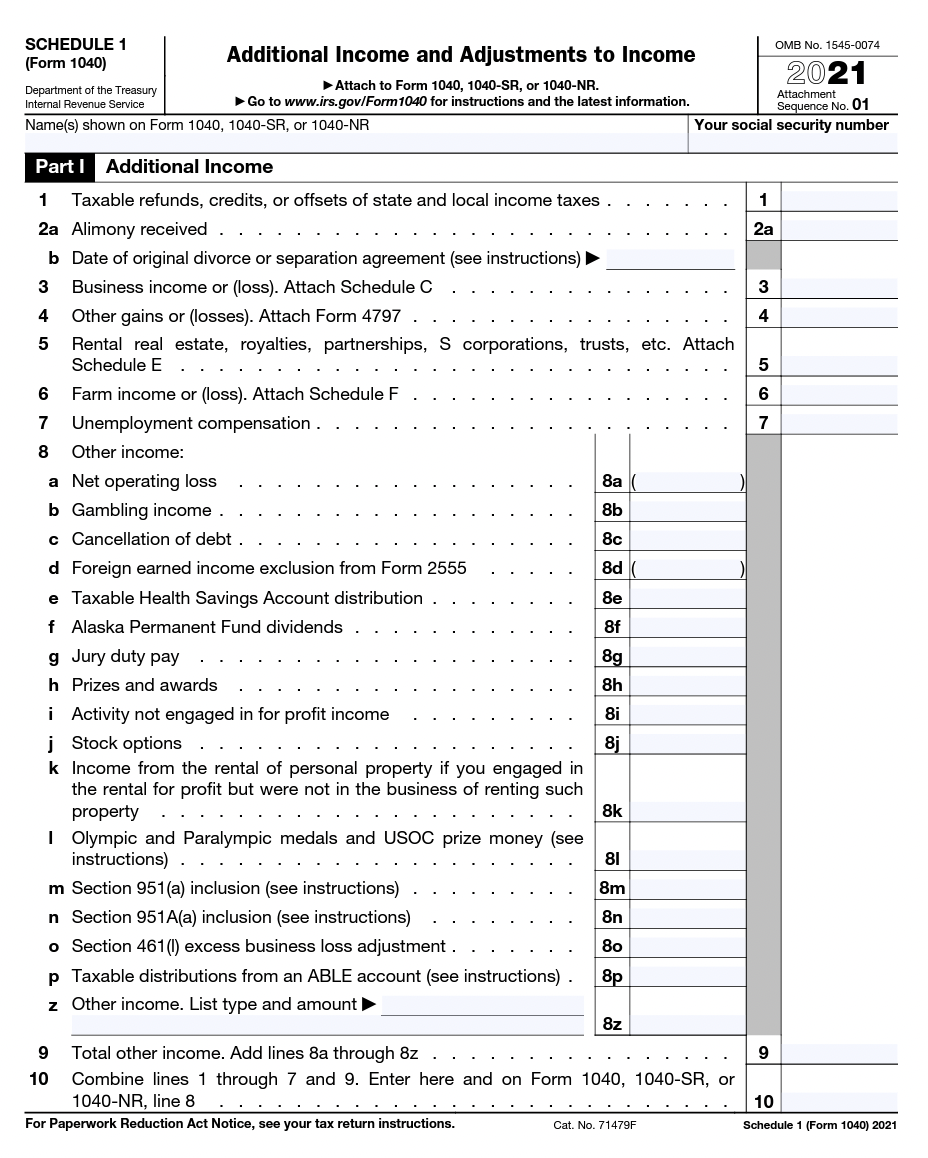

What is IRS Form 1040 Schedule 1? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

Most commonly requested tax forms | Tuition | ASU

Source : tuition.asu.edu

Publication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov

Most commonly requested tax forms | Tuition | ASU

Source : tuition.asu.edu

Business tax deadlines 2025: Corporations and LLCs | Carta

Source : carta.com

Most commonly requested tax forms | Tuition | ASU

Source : tuition.asu.edu

IRS Form 1040 Schedule 1 Intro to the Different Fields YouTube

Source : m.youtube.com

Applying for Financial Aid | Financial Aid | Mesa Community College

Source : www.mesacc.edu

2023 2025 Tax Brackets and Federal Income Tax Rates | Bankrate

Source : www.bankrate.com

Schedule 1 1040 Form 2025 Most commonly requested tax forms | Tuition | ASU: JEE Advanced 2025, organized by the Indian Institute of Technology, Madras, is the key to entering prestigious Indian Institutes of Technology (IITs) and other renowned engineering colleges in India. . Only those students who have cleared the JEE Main 2025 exam and are ranked among the top 2.5 lakh candidates can appear for the upcoming JEE Advanced exam. Additionally, students in the general .